Writing a will is an essential part of planning for the future. It’s a legal document that offers a framework as to how you want your assets to be distributed after you pass away. Despite its importance, people tend to avoid writing a will because they perceive it as a dificult or uncomfortable task or even consider it as an inauspicious thing to do.

However, failing to write a will can have serious consequences for both you and your loved ones. Let’s explore the importance of writing a will and the possible consequences of not writing one.

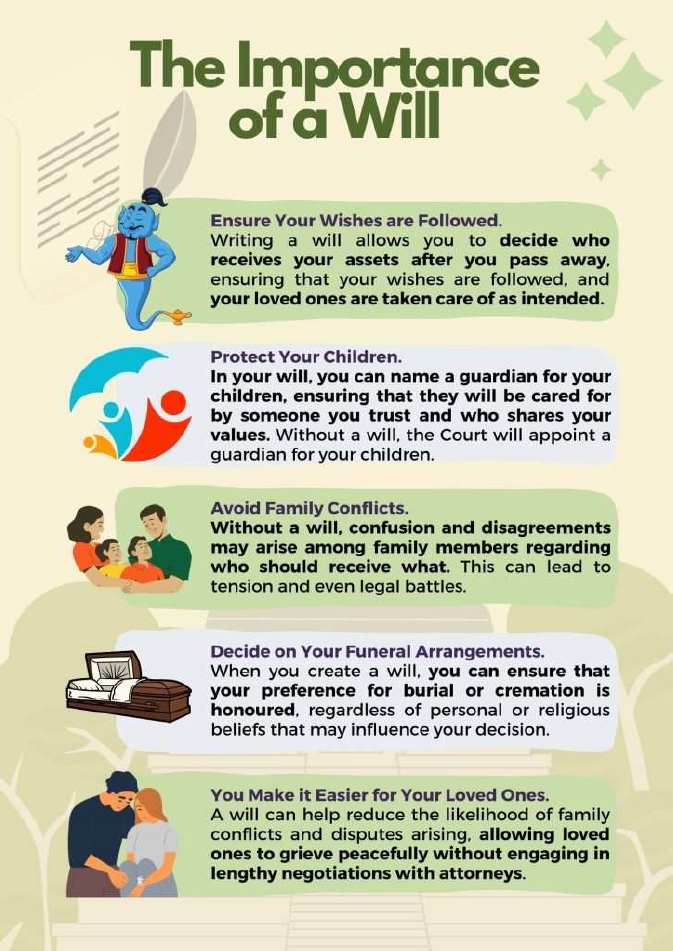

Ensure Your Wishes are Followed

Writing a will allows you to decide who receives your assets after you pass away, ensuring that your wishes are followed, and your loved ones are taken care of as intended. Without a will, your assets will be distributed according to the laws of your state. In Singapore, the Interstate Succession Act determines the distribution of your estate, which may not align with your desires. Consequently, the people you want to receive your assets may not receive them if you do not have a will.

Protect Your Children

Children are a source of immense joy and concern for parents, and it’s crucial to have a trustworthy person to care for them in case of our absence. If you have children under the age of 18, a will is especially important. In your will, you can name a guardian for your children, ensuring that they will be cared for by someone you trust and who shares your values.

Without a will, the Court will appoint a guardian for your children. However, the appointed guardian may not be the person you would have chosen. For instance, the Court may assign guardianship to your brother, while you would have preferred your sister to take on this role instead.

Decide on Your Funeral Arrangements

When you create a will, you can ensure that your preference for burial or cremation is honoured, regardless of personal or religious beliefs that may influence your decision. For instance, many Hindus choose cremation as it symbolises the end of the physical body’s existence and the beginning of a new journey for the soul.

You Make it Easier for Your Loved Ones

The death of a loved one is one of the most challenging moments we can face. However, having a will can reduce the likelihood of family conflicts and disputes arising, allowing loved ones to grieve peacefully without engaging in lengthy negotiations with attorneys. This can provide comfort and sollace during a dificult time.

What Happens if I Don’t Write a Will?

If you don’t write a will, your assets will be distributed according to the laws of your state. This process is called intestacy. The laws of intestacy vary from state to state, but generally, they prioritise spouses and children.

In Singapore, if an individual dies without a will, their assets will be distributed according to the Intestate Succession Act (Chapter 146) Rules of Distribution. These regulations provide specific guidelines for distributing assets in such a scenario, meaning that the family won’t be able to contest the distribution of the estate. The Rules of Distribution dictate that assets will be assigned only to family, spouse, children, and relatives, with precedence given to the spouse and children.

It’s essential to note that without a will, your assets may not go to the people you would have chosen. For instance, if you are in a long-term relationship but not married, your partner may not receive any of your assets without a will. Additionally, a will can address critical issues such as funeral arrangements, charitable donations, and the care of your pets, in addition to the distribution of your assets.

When there is a will, there is a way

In Asian culture, discussing after-death arrangements is often considered taboo. However, creating a comprehensive will is crucial to prevent complicated estate succession problems that could result in financial issues or family conflicts. It may be unwise to assume that your assets are insignificant or that your family members know how you want your estate to be distributed. Crafting a will is a simple process that can effortlessly resolve these concerns and help your family navigate challenging times with fewer complications. Talk to your Financial Consultant if you’d like to discuss about this article and gain more information.